Cocoon Partners With Nuapay To Save Car Dealerships 75% On Payment Processing Fees With Open Banking

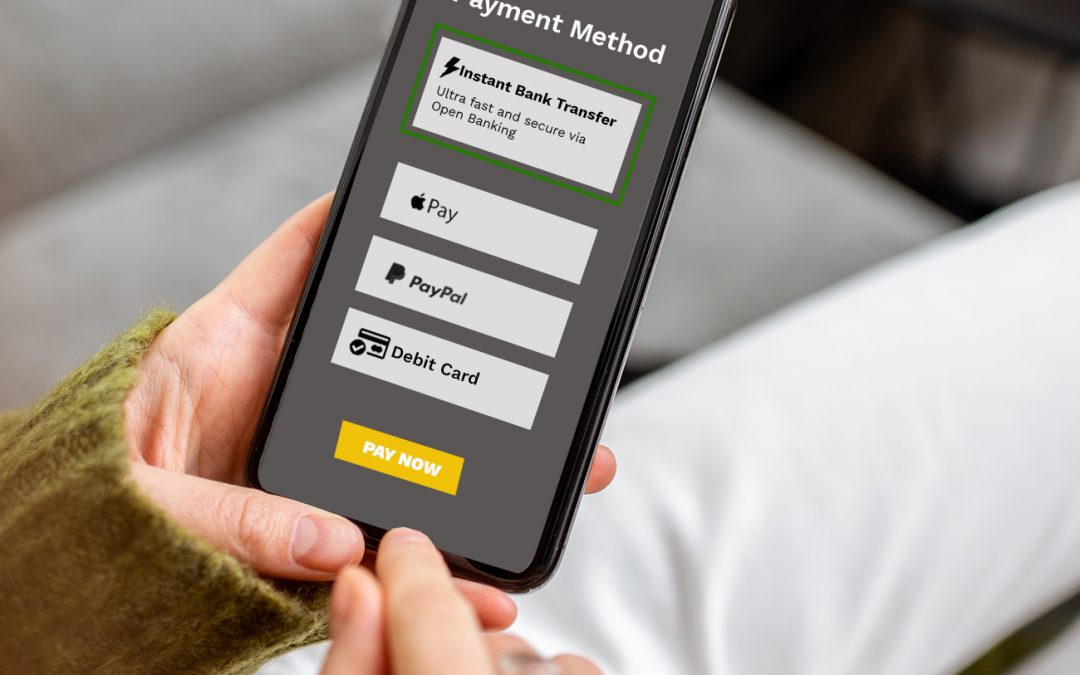

Nuapay is helping Cocoon deliver a better way for customers to pay for automotive purchases. Its simpler, safer and more secure way for customers to make payments directly from their bank accounts helps automotive dealers address the highly compressed margins in car sales (typically

read more