- Convenience is critical to payers, with 52% of consumers choosing their payment method based on how easy it is to use, yet 25% of consumers have lost out on a purchase online due to inefficient payment processes.

- This number rises to 47% for 16-24 year olds – an important spending group for retailers.

- Open Banking is the solution, and 54% of UK consumers are willing to make a payment via Open Banking, yet few retailers give consumers the opportunity to pay this way.

- Nuapay calls for retailer champion to pave the way for Open Banking Payments adoption.

17th December 2020, London: New data from Open Banking pioneer Nuapay, powered by Sentenial, has revealed that consumers are frustrated with the user experience when making card payments online. This follows recent findings that highlighted a raft of payment card security failings. The news comes as retailers ready themselves for the busy festive shopping season – an event that is even more important this year as businesses seek to plug pandemic losses.

In the study of over 2000 UK consumers, 52% of payers choose their payment method based on convenience and ease of use, yet 30% reported that their biggest concern about shopping online is the time it takes to input card details and process payments. Perhaps most worrying is that a quarter of consumers (25%) said they have lost out on purchasing goods or services, such as concert tickets and limited-edition clothing ranges, online or on their mobile because inputting their card details took too long. This rises to a staggering 47% of 16-24-year olds and 44% of 25-34-year olds – two key demographics for many online retailers. Indeed, research found that in 2019 this age range had the highest percentage of online shoppers, with 97% of these adults shopping online within the year.

The research found 54% of UK consumers would be willing to use Open Banking as an alternative way to pay. This rises to 64% of consumers who use mobile banking and can benefit from the most convenient Open Banking payer experience. Unsurprisingly, the younger generations are leading the demand for Open Banking solutions, with 75% of consumers under 34 willing to use Open Banking to make a payment.

Looking at where consumers would be willing to use open banking payments paints an interesting picture. Consumers are more willing to use Open Banking payments for everyday retail, such as groceries, (42%), than big-ticket travel items like flights and package holidays (39%). Financial services (45%), charities (45%) and government (44%) are also all likely to see high adoption rates.

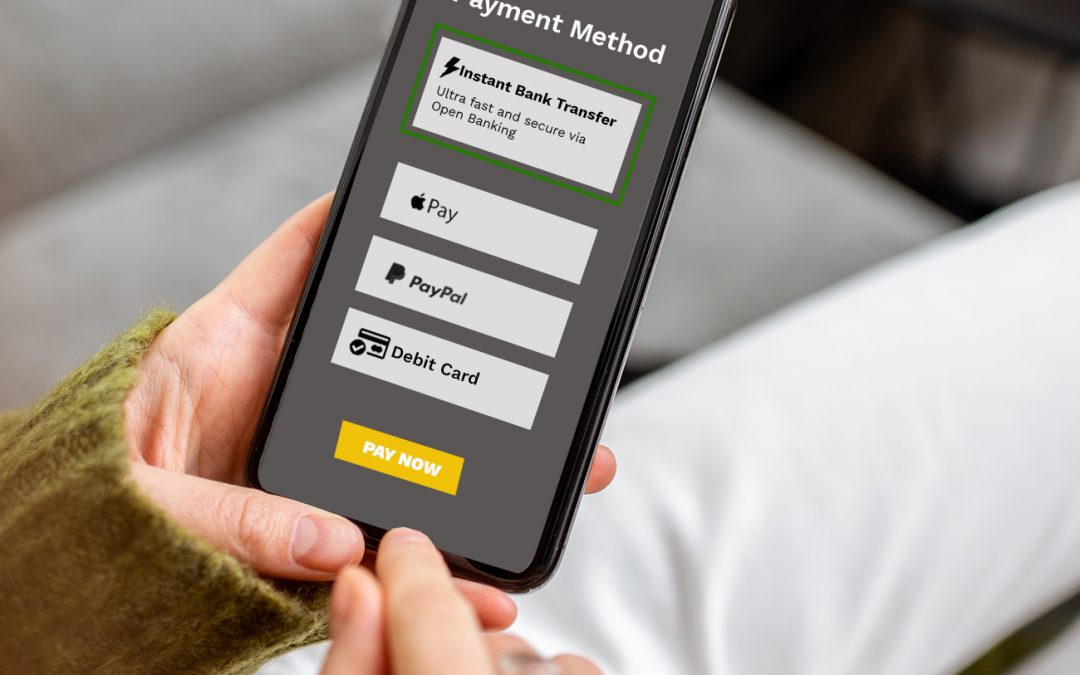

When using Open Banking payments, rather than inputting card details consumers simply authenticate the payment on their mobile device within the natural user flow. By speeding up the process, the user experience is dramatically improved and customers are much less likely to lose out on purchases, as well as reducing the likelihood of abandoned online shopping carts.

A key blocker to this technology becoming mainstream appears to be a lack of understanding. 37% of consumers stated that they would be willing to make an Open Banking Payment if they had increased understanding of Open Banking technology, its security features, or how the payment experience is more convenient than using cards.

This is why Nuapay continues to call for further industry collaboration to improve consumer understanding and increase adoption.

Nuapay also took the survey as an opportunity to educate respondents, who were enthusiastic about the technology after it was explained. One third (33%) of UK consumers said that a trusted brand could influence them to use Open Banking as a viable alternative to credit or debit cards in situations where they are not yet willing to pay with Open Banking. This rises to around 2 in 5 payers (42%) in the 16-24-year old age bracket.

The opportunity is ripe for a leading retailer to become the pioneering brand that makes Open Banking payments mainstream. This would not only enable a low-friction payment experience for shoppers online, but allow retailers to reduce their payment processing costs by avoiding card scheme fees. In addition, all Open Banking transactions are fully Strong Customer Authentication (SCA) compliant, making them far more secure. In fact, amplifying the stark necessity of consumer Open Banking adoption, is the finding that more than one in ten (12%) of the UK consumers surveyed claim to have had a payment made from their debit or credit card without their permission in the last 6 months alone.

Nick Raper, Head of UK at Nuapay says: “Collectively, the data shows consumers have a strong willingness to adopt new payment solutions that improve convenience and security over traditional payment methods. It’s clear that Open Banking technology needs a leading consumer brand to kick start the revolution that has been coming since its inception – a retailer who can do for Open Banking what Transport for London did for contactless. Retailers have an opportunity to provide a payment method with the numerous advantages Open Banking can bring to both their business and consumers. Consumers are assured safe, secure, and efficient payments in-store and online. In turn, retailers can improve the customer experience to increase sales and reduce cart abandonment.“

Read the full report here

Learn more about open banking